Understand Australia

Weekly COVID news at a glance

Published

2 years agoon

By

lily

1. International travel vaccination certificates

The proof will be available to Australian passport holders and Australian visa holders who have their COVID-19 vaccinations recorded on the Australian Immunisation Register, government ministers said in a joint statement on Sunday night.

The proof will enable fully vaccinated Australians to depart Australia and travel internationally consistent with the National Plan to transition Australia’s COVID-19 Response.

It can be downloaded digitally or in printed form and is compatible with COVID-19 travel apps such as the International Air Transport Association (IATA) Travel Pass. The federal government has announced that international travel restrictions will start to ease from the beginning of November for fully vaccinated Australians.

2. Contact tracer changes

Victoria’s contact tracing systems are changing, as the state’s reaches what health officials hope is the peak of COVID-19 case numbers

Previously, the goal was to stop and track every case, but now the focus is on the cases that are the highest risk. It means people who test positive will be treated differently, depending on who they are, where they work and whether they’re vaccinated.

For example, when someone young and healthy tests positive, they might only receive a text to isolate. But someone who is at risk of severe illness, such as the elderly or immunocompromised, they will receive a call and further communication.

3. Home COVID-19 tests approved in Australia

Three COVID-19 self-test kits with an accuracy of around 97 per cent will hit pharmacy shelves on 1 November. The Therapeutic Goods Administration has given the Chinese-made tests the green light, as attention turns from lockdowns to living with the virus.

Two of the rapid antigen tests involve spitting in a tube while the third is a nasal swab. The instructions note that if there is a positive result, confirmation must be sought via a laboratory PCR test.

4. Quarantine-free travel

Quarantine-free travel between Australia and the South Island of New Zealand is ready to resume, Chief Medical Official Paul Kelly says. He said NSW and Victoria have agreed to allow trips to restart from midnight on Tuesday given there has not been a COVID-19 case in the South Island since last year.

“We hope to allow anyone who has been in the South Island of New Zealand whether Australian, New Zealanders or other nationalities, as long as they have been there for 14 days, to come in quarantine free.”

Health Minister Greg Hunt said he has also been in discussions with his Singaporean counterpart about a green lane travel bubble for fully vaccinated travellers from the Asian city-state.

5. Supply for new COVID-19 treatments

Australia has secured two additional COVID-19 treatments, but Health Minister Greg Hunt has made it clear they are not replacing vaccinations.

The government has reached an agreement with Roche Products to supply 15,000 doses of the COVID-19 antibody-based therapy Ronapreve. Mr Hunt said the intravenous treatment given in the early stages of infection provides a 70 per cent reduction in the likelihood of someone being hospitalised or dying.

The government has also secured 500,000 courses of Pfizer’s COVID-19 oral antiviral drug, which will be available in 2022 subject to Therapeutic Goods Administration (TGA) approval.

Pfizer’s COVID-19 oral antiviral drug

COVID-19 antibody-based therapy Ronapreve

6. Vaccines safe for fertility and pregnancy

Experts are concerned about pregnant women holding back from getting their COVID-19 vaccines due to misinformation. There is no evidence that the vaccine is harmful.

Scientific data shows that vaccines have no effect on fertility and are safe while pregnant. Senior Lecturer in Gynaecology and obstetrics, Michelle Wise, said there is evidence that the real cause of severe disease in pregnant women is the COVID-19 virus

Currently in the UK, one in six of the most critically ill COVID patients are unvaccinated pregnant women. Myths around vaccines affecting fertility can be traced back to American websites that highlighted a European doctor’s claims in 2020 while the vaccine was in stage 3 trials. But studies have since confirmed his claims were not proven or factual and there has been NO reports of infertility or miscarriage in relation to the vaccine.

You may like

Understand Australia

Australia’s Multicultural Future

Published

4 weeks agoon

March 19, 2024By

lily

The National Multicultural Festival, organised by the Australian Capital Territory Government, was held in Canberra from 16 to 18 last month. Next Monday also marks the start of Australia’s Harmony Week. In Victoria, the government’s campaign focuses on Cultural Diversity Week to celebrate Australia’s multiculturalism, while Australia’s Harmony Day coincides with the International Day for the Elimination of Racial Discrimination, which falls on 21 March every year. More and more people are realising that Australia has a long way to go to achieve its goal of creating a society where everyone feels included, respected and has a sense of belonging.

With different names and priorities reflecting the different approaches of different governments, and with newcomers often not understanding the differences, it’s time to think about the festivals that affect our lives.

We are one family

Australia’s National Harmony Day, celebrated annually on 21 March, began in 1999, when South African police shot and killed 69 unarmed blacks on 21 March 1960 at a rally against the passing of anti-black laws. Six years later, the United Nations designated this day as the International Day for the Elimination of Racial Discrimination, and different countries around the world remembered this disastrous day in South Africa.

In 1998 the Department of Immigration and Citizenship commissioned Eureka Strategic Research to conduct the first national survey of racial attitudes among Australians. The resulting report recommended that the government mould the belief that Australian society is fundamentally harmonious and that this harmony should be celebrated. The purpose of Harmony Day is to strengthen the cohesion and inclusiveness of all peoples in order to promote tolerance and multiculturalism, and in particular to increase understanding and respect for each other’s races, cultures and religions. The whole week from Monday to Sunday, which includes Harmony Day, is known as Harmony Week. In Victoria, this week is known as Culturual Diversity Week. Every year, the Victorian Government supports a variety of multicultural activities with funding from the Victorian Multicultural Commission.

Today, Australia is probably one of the most successful multicultural societies in the world. This multicultural integration was not achieved in a single day, and it has been a difficult journey. Since the 19th century, the vast majority of immigrants to Australia have come from the United Kingdom, and the establishment of Australia as a white society has been a driving force behind the country’s development. Until World War II, Australia was a racially and culturally homogenous society based on British values and institutions. The Second World War was a turning point in Australia’s immigration history, forcing Australia to implement a large-scale immigration programme that recruited immigrants from a wide range of non-English speaking countries and regions. The influx of immigrants from an increasingly diverse range of sources resulted in an increasingly ethnically diverse population.

Australia’s history of multiculturalism is different from that of any other country in the world. Until the government legislated to abolish the White Australia policy 51 years ago, very few non-white immigrants came to Australia, and only a small number of non-English speaking European immigrants were able to settle in Australia. It can be said that the first non-English speaking immigrants were all European immigrants mainly from Italy, Greece and Germany, which made Australia maintain the European culture, and it was only in the 1980s and 1990s that Asian and African immigrants settled in Australia. It can be said that Australians in their fifties and sixties rarely have the opportunity to meet non-whites in schools, and it is only in the past 30 years or so that multiculturalism has been promoted. The promotion of Harmony Day and Harmony Week was the government’s attempt 25 years ago to educate the community about Australia’s entry into a multicultural society. If the government does not do its best to promote these changes, I believe it will be very difficult for Australians over the age of 50 or 60 to embrace multiculturalism.

From Aboriginal and Torres Strait Islander beginnings, through to the establishment of the British system, and on to new chapters written by people from far and wide – successive governments have set out a vision of an Australian society that embraces diversity and emphasises the importance of our unique national identity and of cohesion and unity among our people. According to the 2021 Census released by the Australian Bureau of Statistics, more than half (51.5 per cent) of Australians across Australia were born overseas themselves or to at least one parent. Overseas-born first-generation migrants make up more than 30 per cent of the total population. Apart from English, the five most spoken languages are Mandarin, Arabic, Vietnamese, Cantonese and Punjabi.

Whilst the White Australia Policy may be history, Australia still has a long way to go on the issue of race. Racialisation is a “disturbing fact” in Australia, as evidenced by the ethnocultural composition of parliamentarians, and it remains an undeniable reality of society that some groups are racially privileged while others are racially marginalised. It is not easy to realise diversity, and it is even harder to maintain it. It is only when communities come together and engage in genuine dialogue on an equal footing that the vision of ‘we are one family’ can be truly realised.

Society still fails to understand the meaning of cultural diversity

Despite the efforts of Harmony Day and Harmony Week, we must not lose sight of the fact that the governing class of Australian society, the 50 and 60 year olds, have very little contact with multicultural immigrants, and furthmore this contact is superficial, except for very senior managers, who seldom have any in-depth contact with multicultural immigrants. As a result, it is not easy for them to effectively implement multicultural governance in their work and systems.

Let me cite an example that has had a far-reaching impact in recent years. In the early days of the pandemic, the government disseminated information on a daily basis about the spread of the pandemic and the need to reduce the speed and magnitude of the spread of the virus. Officials such as the Minister of Immigration, the Prime Minister, and the Premiers all claimed to have done their best to get the message out to the multicultural community. However, they were only referring to information that had been translated into different languages and posted on the Ministry of Health’s English-language website for people to download. The ethnic media pointed out at the time that most of the information had been translated and posted on the website a week later, and that many of the translations were wrong, which was incomprehensible. The officials in charge of the project just said that they had not ignored multiculturalism, but they did not even consider how many people in the multicultural community had received the information.

The result was that six months later, studies showed that overseas-born Australians had more than double the infection and death rates of their native-born counterparts. And the number of immigrants fined for breaching the isolation order, particularly those from African and Arab countries, was several times that of English speakers. In the face of this overwhelming evidence, state governments have recognised the importance of communicating information about the epidemic to multicultural communities, and have established effective channels for the dissemination of information.

Victoria’s Premier Andrews had told this magazine that the state’s spending on outreach to multicultural communities has risen dramatically from 5 per cent of the total to over 12 per cent of the total in order to cope with the past. In the 2022 election, he has pledged to increase this to 15 per cent. On the other hand, Matthew Guy of the Liberal-National Coalition only promised to provide 10%, clearly ignoring the needs of the multicultural community. The fact that all immigrants abandoned the Liberal-National Coalition in the Victorian parliamentary election shows that when leaders neglect the management and operation of a multicultural society, they are unable to formulate effective governance policies, and at the same time, they lose the opportunity to do so.

The need for an up-to-date framework review

Australian Harmony Week is a time to celebrate Australia’s multiculturalism and the successful integration of new migrants into the Australian community. It is an opportunity for all Australians to embrace their cultural diversity and to share the values that are common to all of our people, regardless of their cultural and linguistic backgrounds, united by Australia’s core values. A united, multicultural Australian society is an important part of Australia’s history and identity.

The intention is good, but that doesn’t mean it won’t have unintended consequences.

The International Day for the Elimination of Racial Discrimination (IDERD) was an opportunity to recognise Australia’s deep-rooted problems of race and racism in a meaningful way, to challenge the ways in which racism affects our society, and to increase our commitment to the fight against racism. Since 1999, however, Australia has rebranded the International Day for the Elimination of Racial Discrimination from a day of solidarity with those fighting racial discrimination to a festival of celebration and the focus of ‘Harmony Week’. Within this framework, the systemic racism suffered by so many people in Australia over so long a period of time was effectively hidden. The fact that there are still people in Australia today who deny the existence of racism is a major contributing factor.

The promotion of harmony has been a feature of Australian policy and politics for more than two decades. Whilst the concept of ‘harmony’ can be a positive message, there are many problems with overriding the International Day for the Elimination of Racial Discrimination, one of which is that it can discourage people from speaking out against racism, as it may be seen as contrary to a harmonious Australian society. Turning the other cheek and ignoring it is a self-defeating approach that does more harm than good to building a truly fair and equal society that recognises the fundamental rights and freedoms of all people.

In 1973, the Whitlam government released A Multi-cultural Society for the Future, signalling the birth of contemporary multicultural Australia. Last year, on the occasion of its 50th anniversary, the federal government launched the Multicultural Framework Review to encourage public participation. After all, Australia’s multiculturalism policy has been in place for nearly 50 years, and the national and international social landscape has changed dramatically. Only by truly listening to the voices of the people can we continue to support a cohesive and inclusive multicultural society under the new circumstances, and achieve our goal of utilising the talents of all Australians.

Getting it right is the real thing

In recent years, ‘diversity, equity and inclusion’ has become a buzzword for companies and organisations across the globe, reportedly spending around A$7.5 billion on Diversity-Equity-Inclusion (DEI)-related programs in 2020 alone, a figure that is expected to double by 2046. In reality, the more important question is whether these ‘diversity-equality-inclusion’ programmes are being implemented on the ground, rather than just sitting on the shelf as lofty rhetoric. In Australia, some diversity programmes have made progress in addressing gender inequality, but not so much in other areas, such as race.

Although racism has been consigned to the dustbin of history at the political and legal levels, the rise of the anti-Asian, anti-Indigenous and anti-immigrant ‘One Nation Party’ at the end of the twentieth century, the repeated attacks on Chinese students in Melbourne and Sydney in recent years, and the fact that the ‘Miss Australia 2017’ claimed to be a Muslim, which has often led to her being given the cold shoulder, are all indicative of the hatred of minorities. …… This is a sign of the fact that Australia is not only a place where people who are not Muslims can live in the world. This is a sign that the ghost of hatred against ethnic minorities has not yet dissipated. Whenever there is a disease, plague or economic crisis, ethnic minorities are targeted, and the new crown epidemic has accelerated the spread of the racist virus.

It is not difficult to see that white supremacy is still deeply rooted in some people. They believe that Western culture is superior to other cultures, that human history and development revolve around the West, that white people are superior to other coloured people, and that they try every means to protect the superiority of the white people in the political, economic, social, and cultural fields, and that they often show arrogance and prejudice when they face coloured people. This shows that Australia still has a long way to go to realise the core of multiculturalism, which is ‘equality’. Prejudice and xenophobia are the public enemies of modern civilisation, creating divisions between communities, breeding hatred, crime and conflict, and only hurting each other, with no ultimate winners.

In order to safeguard Australia’s cultural diversity, which is the most important aspect of Australian identity, the general public and social elites should not look on with a cold eye at white arrogance and prejudice, nor should they merely state their position. Instead, they should start from their daily lives and become the supportive force against racial discrimination. The upcoming ‘Harmony Week’ also provides an excellent opportunity for ethnic minorities in Australia to take the initiative to speak out for their rights through the media, the press and rallies, as well as to gain more voice through active participation in politics on a regular basis.

Author/ Editorial Department, Sameway Magazine

Photo/Internet

Understand Australia

Australia’s Tax Cut Third Stage of Chaos

Published

4 weeks agoon

March 19, 2024By

lily

The last Coalition government successfully pushed then-opposition Labor into the corner of publicly supporting its tax cuts. In the 2019 general election, Labor’s tax issue dominated the agenda and ultimately lost the election, and after voting in Parliament to support the Coalition government’s tax cuts, Labor doubled down on its 2022 campaign, with Albanese promising to keep the previously passed tax cuts if it won the election. The Labor Party has not publicly proposed to shelve or amend the tax cuts that have already been passed, but the winds of the tax cuts have been blowing through the media backstage for a few times, but they have soon passed. However, a few days ago, Prime Minister Albanese used the National Press Club to announce the third phase of the revised tax cuts: by lowering the tax cuts for high-income earners, it will be reversed to benefit low and middle-income earners in Australia. There was not much opposition to this proposal in today’s society under the pressure of high cost of living, but there was a lot of discussion on whether Labor had reneged on its election promise. A stone has stirred up a thousand waves.

Whether this is a betrayal of the electorate by the government is a matter of opinion.

Low- and middle-income earners will benefit

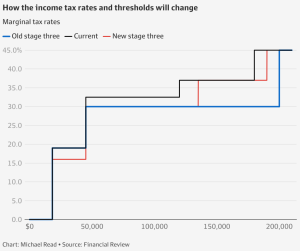

In 2019, the Coalition government hoped to stimulate the economy and solved the problem of ‘budget creep’ through tax cuts, so it has launched a three-stage tax cut program. Currently, Australia imposes a tax on personal income, which is a progressive tax system. This means that the amount of personal income will be subject to different tax rates, which will be gradually increased according to the amount of income.

To put it simply, there are 5 tiers.

The tax cuts will be implemented from July 2020 onwards, with a higher range of tax bands to allow lower income earners to enjoy a lower tax rate. For example, the 19% tax bracket was raised from $37,000 to $45,000, and the 32.5% tax bracket was changed from $90,000 to $120,000 to allow low-income and middle-income earners to enjoy lower tax rates. This change does not reduce the tax for high income earners who earn more than $200,000 and still have to pay 45% tax on every dollar of income after $180,000. To the high-income earners, such a tax system does not encourage them to earn more money. The third phase of the tax reduction scheme was originally intended to give more tax concessions to high-income earners.

Specifically, because tax brackets do not automatically adjust for inflation, this means that over time, as an individual’s salary rises, so does their average tax rate, meaning that a raise in salary results in a person paying a larger percentage of their income in taxes. Previously, Phase I and Phase II tax cuts were already in effect for low- and middle-income families. The third phase of the tax cuts is intended to stimulate the economy through these changes by encouraging people to work more and earn more, as the extra income will be disproportionately seen as less of a disincentive to pay taxes. However, there are opposing voices that say the cuts will have an inflationary effect on the economy because people will have more money to spend, which will further drive up the cost of living.

Under the Coalition’s previous plan, the third phase would have abolished the 37% tax rate and introduced a flat rate of 30% for taxpayers earning between $45,000 and $200,000, while under Labor’s adjusted policy, the rate would have been reduced to 30% for taxpayers earning between $450,000 and $200,000. According to Labor’s adjusted policy proposal, from July 1, for most workers, the new tax cuts will be better than the current rules, especially expanding the scope of the third stage of the tax cuts, the previously announced third stage of the tax cuts will not reduce taxes for people earning less than A$45,000, while the latest plan to ensure that “everyone” will receive tax cuts, so that low-income earners will benefit; and the tax cuts for high-income earners with income of $200,000 and above, will not be applied to those earning more than $200,000, so that low-income earners will benefit from the new tax cuts. The tax cuts for high earners earning A$200,000 and above will be cut by almost half.

Specifically, those earning an average of A$73,000 a year will receive a tax cut of more than A$1,500 a year. Those earning A$50,000 a year would receive an additional A$929 a year, while those earning A$100,000 would receive A$2,100 a year. In the higher income groups, those earning A$200,000 a year will see their tax cut reduced from A$9,075 to A$4,500 a year. Overall, the one million Australians earning more than A$150,000 are worse off under the proposed reforms, while those earning less than that amount have more tax cuts. Labor MPs have confirmed to the ABC that the revised package has been passed within the party. Federal Treasurer Jim Chalmers said the changes would give people more help in dealing with the cost of living crisis. The Labor government estimates that the tax cuts will benefit around 13.6 million Australians.

Betrayal of election promises or going with the flow?

As soon as Labor’s proposed changes to the third phase of the tax cuts were announced, Shadow Treasury Minister Angus Taylor immediately took the position that the Labor government’s breaking of its ironclad election promises meant that Labor had broken its election promises. He reminded Albanese that Australians had voted for the policy at two elections (2019 and 2022), so today was a reversal by the incumbent government of a policy it had supported during the campaign. The Deputy Leader of the Opposition, Susan Rye, even called Albanese a ‘liar’, suggesting that Albanese, who insisted in the election that he would do what he said he would do, and that he ‘would not change the third phase of the tax cuts’, had lied his way to a general election victory. Of course, Albanese has his own reasons for this decision – it’s because the global economy has changed since Morrison’s legislation in 2019.

That’s true. Over the past three years, there have been pandemics, recessions, and global inflation, affecting not one war, but two. Albanese pointed out that the changes to the tax cuts were in response to the huge cost of living pressures being felt by the Australian people at the moment, and that the right decision had to be made to make changes accordingly. Jim Chalmers has also defended the government’s new proposal as an approach that will work and provide middle class Australians with the cost of living relief they so desperately need for the same amount of money. The package of Stage 3 tax cuts is scheduled to be legislated by Morrison in 2019, so rewriting this plan bypasses parliamentary approval until July. This means that the government will need the support of the Greens and neutral MPs in order to change the tax cuts that were previously required. According to the opposition’s current stance, it will oppose any changes to the third phase of the tax cuts.

Opponents argue that today is a good day, the world is facing inflation, the cost of living is under pressure, but why doesn’t the government propose a subsidy or other increase in profits tax on large corporations, so that the money goes directly into the hands of the people who are facing difficulties, or let investors pay more taxes, so that they can make less profit? Taxing the high-income earners directly is a clear attempt to gain the approval and support of the majority by bullying and deceiving a small group of people in the community.

However, it is clear that the new program is designed to provide more support to middle income earners who are facing cost of living pressures, and to provide assistance without exacerbating inflation. On the other hand, it would be responsible to change policy when the economic situation changes. After all, equality is one of Australia’s core social values, and it’s always been the government’s responsibility to leave no one behind. It’s just a matter of clarifying where the limits lie and who determines them, or else this kind of reneging on election promises will be repeated, and will have a long-term negative impact on maintaining public trust in the government.

Trust compromised

While the Labor government is lobbying for changes to the third phase of the tax cuts, Treasurer Jim Chalmers has promised that there will be no changes to the negative deduction policy, which is not something that Labor has considered or is considering. But the Opposition says that given that Labor has violated the public trust by changing the third phase of the tax cuts, it needs to be more specific about its commitment to negative withholding this time around. After all, a politician’s credibility with the electorate depends on keeping his word, but it seems that the Labor Party has gone back on its word and broken its promise. It’s no wonder that Liberal frontbencher Dan Tehan wants Labor to explicitly rule out any changes to the negative tax deduction policy, after all, Labor has betrayed the public’s trust by reneging on its promise to change the third stage of the tax reduction plan.

The newly released report, Everyone’s Loss of Housing, warns that the negative deduction policy encourages people to invest in property through tax cuts that could have been used to build more homes; and that if the focus of government subsidies isn’t changed from property investors to those who have been squeezed out of the market by high house prices, the housing crisis will only get worse. Jim Chalmers, on the other hand, said that the government had found other ways to reduce the pressure on the housing market, including encouraging the construction of more ‘build-to-rent’ homes.

The tax cuts have been redistributed under the revised third phase of the tax cuts, with lower and middle income earners benefiting more and higher income earners receiving smaller cuts – and everyone knows it. After all, next year is another election year in Australia, and Labor’s move is nothing more than a gesture of goodwill to the low and middle income voters, and there is no way to avoid the suspicion of buying people’s hearts and minds. It is impossible to avoid the suspicion of buying people’s hearts and minds. And such a move will only arouse great resentment and opposition from the opposition party. At present, the biggest uncertainty is whether the Labor Party’s amendment plan will be passed in the legislature to realize the legislation; however, the Labor Party has a better chance of winning. After all, this change is also in line with the Green Party’s political position, which is to demand more support for low-income earners, and to raise the threshold of tax exemption, so that more low-income earners will not have to pay any tax. In the long run, Labor’s reneging on its primary election promises will be a source of confusion and even resentment for voters. After all, Australian voters, who have been immersed in the democratic world for so long, are not so easy to fool, and backtracking on their promises is often a big step down for those who believe in simplicity and simplicity.

Author/Editorial Sameway

Photo/Internet

Understand Australia

Revelations from the First Australian Anti-Foreign Intervention Law Case

Published

4 weeks agoon

March 19, 2024By

lily

With Christmas and New Year approaching, everyone was immersed in the festive atmosphere. However, a case that has been waiting for nearly three years for a verdict, like a bomb, has aroused the close attention of the Chinese community – Mr. Sunny Duong, a Chinese leader in Melbourne, was convicted by a jury of the Victoria Court of the charges related to foreign interference, making him the first person to be convicted of a crime under the Anti-Foreign Interference Act since the introduction of the law in Australia in 2018. Mr. Duong was convicted by a jury in a Victorian court of foreign interference-related charges. A stone has stirred up a thousand waves. Is this judgment a “stone throw” by the Australian government? Or is it a warning signal to the Chinese government? Our editorial team will guide you to find out.

Court found guilty

On December 19, 2023, 68-year-old Melbourne businessman and Chinese community leader Sunny, Di Sanh Duong) was convicted by a Victorian court of violating the Anti-Foreign Interference Act, making him the first person to be convicted under the law since the introduction of the Anti-Foreign Interference Act in 2018 in Australia. This makes him the first person to be convicted under the Anti-Foreign Interference Act since it was introduced in Australia in 2018. Sunny was released on bail after his conviction and will return to court in February 2024 to be sentenced. Bail conditions include reporting to police every day and not leaving the state.

The law in question does not charge Sunny with spying in a foreign country. Every country has an espionage or treason law, which is a national security law, and in 2017 discussions began on the creation of an Anti-Foreign Interference Act, which would address the influence of foreign governments on Australian society and officials. Australians enjoy freedom of speech, but if community organizations or leaders, with the support of foreign governments, initiate actions through community organizations that support other countries and oppose Australian government policies, or even attempt to influence politicians, officials and others in the community to change Australia’s policies, this is precisely the reason for the Anti-Foreign Intervention Act. For many Chinese community organizations, especially those with countless ties to the Chinese government, not many people understand the purpose of the Australian government’s legislation, and few people are concerned about whether the activities of these organizations have already fallen into the activities that are not allowed by the law.

What is the offense?

Sunny Duong, a Vietnamese-born Chinese, has been a member of the Liberal Party of Australia, has held a number of key positions in Chinese organizations, is a well-known leader of the Asian community in Australia, and has been accused of being associated with the Global Overseas Chinese Association for the Peaceful Reunification of China (GOCAPRC), an organization run by the United Front Work Department of the Central Committee of the Communist Party of China (CPC). In October 2020, the Australian Security Intelligence Organization (ASIO) and the Federal Police indicted Sunny Duong, alleging that he had prepared or planned to engage in acts of interference on behalf of a foreign country, had frequent contact with Chinese intelligence officers, and had attempted to influence then Federal Minister Alan Tudge to gain political influence on behalf of China.

In June 2020, Sunny Duong donated A$37,450 to the Royal Melbourne Hospital on behalf of the Chinese community. The donation was made at a time when there was a shortage of critical medical equipment during the Covid-19 pandemic lockdown. The money was raised in his capacity as chairman of a Chinese clansmen association. Sunny told a colleague that he was building a relationship with Alan, who was “going to be the prime minister in the future” and could be “a supporter of ours”. Alan Tudge, who has not been charged with any wrongdoing, told the court that he was concerned about the “ugly racism” facing Australia’s Chinese community in the wake of the outbreak.

Some in the Chinese community saw no reason why Sunny Duong should be convicted for handing over the donations to Tudge. The fact that the donation was not made by Sunny Duong, nor was it a private bribe for illegal purposes, and that it was not a large amount, is considered a form of political persecution. The fact that the donations were not made was seen as a confirmation of Sunny Duong’s attempt to demonstrate his influence in the Chinese community and to establish a personal relationship with Tudge as a government minister. This is one of the fundamental things that the Anti-Foreign Interference Act recognizes. Of course, the violation of this law depends on whether the person concerned has an agent relationship with the foreign government or whether the act was authorized by the foreign government. The prosecution also presented more evidence to convince the jury.

Neil Cleland, Sunny Duong’s defense lawyer, argued that the donation was simply a way to combat the surge in anti-Chinese racism due to the pandemic and to show concern for the Chinese community in Australia, but barrister Sophie York disagreed, pointing out that the defendant’s attempt to defraud under the guise of charity was revealed in court, but that the defendant and his legal representatives incorrectly claimed that it involved “racial discrimination”; York also pointed out that the case was a “racially motivated” one. York also noted that the verdict in this case will inspire police officers, prosecutors and future juries to put justice and the laws that protect national security ahead of false and tactical accusations of racism.

The warning signs are clear

In recent years, as Australia-China relations have hit rock bottom and Australia’s fears of Chinese influence in its domestic affairs have grown, comprehensive legislation introduced a few years ago to prevent foreign interference has only now been put into practice in a real court of law. The decision in the Sunny Duong’s case is undoubtedly a landmark warning to Chinese agents of clandestine infiltration, and signals a long-overdue change of attitude on the part of the Australian government. For too long, important issues of national security and sovereignty have been ignored by the Australian government, with the mistaken belief that even treasonous criminals should “be tolerated”.

In September 2023, the Australian Security Intelligence Office (ASIO) released its annual report for 2022-2023, stating that foreign spies were “actively stealing secrets about defence capabilities, political parties, foreign policy, critical infrastructure, space technology, academic research, medical advances, key export industries and personal information”. (Mike Burgess, ASIO’s director, said ASIO has adopted “a more aggressive counter-espionage and anti-foreign-interference posture” over the past year, adding that prosecuting people charged with foreign interference “will have a chilling effect on hostile foreign intelligence agencies. The conviction of Sunny Duong is the beginning of the “knocking down of the mountain to shake the tiger”.

During the investigation of the case, there was a secret recording of Sunny Duong telling a colleague, “What I am doing will not be reported by the media, but Beijing knows what I am doing. This recording is believed to be the most unfavorable testimony against Sunny Duong’s conviction. Sunny Duong’s high-profile bragging about his relationship with Beijing, coupled with the fact that he was the leader of a group that mobilized the Chinese community to organize a march in the city center in 2018 to show the Australian government that “the South China Sea belongs to China,” is believed to have increased the likelihood that jurors would find him guilty of acting as an agent of a foreign government.

Zhang Yaozhong, a professor at Deakin University’s School of Information Technology, also pointed out that from objective data, we can determine that the severity of China’s interference in Australia, especially in the economy, media, and domestic politics, is much higher than that of most countries, including the purchase or funding of MPs and state legislators to increase China’s influence, or interfering in elections to help pro-China legislators to be elected, and so on, which is a worrisome situation.

Patrick Doyle, the Attorney who prosecuted the case, told the court that Sunny Duong, a former candidate for the Liberal Party in Victoria and a leader in the Chinese community, was an “ideal target” for the Chinese Communist Party’s (CCP) United Front Work Department (UFWD), and that one of the main goals of the UFWD was to win friends for the CCP, and that this included garnering sympathy for the party and its policies. The judge also agreed with the prosecution that the police did not need evidence that Sunny Duong planned to commit future acts of interference in order to prosecute. This case is the beginning of a re-examination of how the previous Australian government’s overly soothing and moderate attitude may well have provided potential criminals with too much leeway to take advantage of Australians. From now on, Australians will have to be more vigilant when it comes to national security.

What will happen to the Chinese in Australia?

The Anti-Foreign Interference Act (AFIA) requires political lobbyists to declare to the authorities whether they are working for another country’s government. Refusal to disclose will result in criminal prosecution, and the penalty for interfering with the activities of government officials has been increased significantly to a maximum of 10 years’ imprisonment if convicted. Before this law was enacted, many Chinese community leaders, or leaders of social organizations, were members of some Chinese government-affiliated organizations. Most Chinese people were unaware that some of these organizations might be considered by the Australian government as part of the Chinese government. In the case of Sunny Duong, some of the departments organized by the United Front Work Department of the Chinese government were considered part of the government. However, it is not necessarily true that all of these united front units are regarded as secret service organizations. For example, many cities in Australia have sister-city relationships with Chinese cities, and it is not clear whether the organizations involved constitute agents of foreign governments.

The conviction of Sunny Duong is just the beginning of what is obviously a huge deterrent to Chinese infiltration of Chinese expatriates in Australia over the past few decades, and the Australian government hopes to see a significant reduction in such activities. But for the millions of Chinese living in Australia, this is a case where it is important to think about how they can better integrate into the local community without being affected by their close relationship with China.

When the bill was tabled in the Australian Parliament, the then Prime Minister, Mr. Malcom Turnbull, made allegations of Chinese government interference in Australian politics and universities, which led to an angry reaction from the Beijing authorities. While the Australian government can ignore Beijing’s reaction as a matter of national security and sovereignty, more resources are needed to inform the public, especially the migrant community, about the kinds of behaviors that could result in assisting foreign powers to interfere in Australia’s internal affairs and society. It is also important to think about how to avoid xenophobic or discriminatory behavior that may result from the publicity given to the bill, as this could further polarize and divide the community.

From the perspective of the Australian government, any requirement for organizations affiliated with the Chinese government or government-linked organizations to conduct activities overseas is a cause for concern. Even if apparently well-intentioned, the underlying intention may be to help deepen the CCP’s influence overseas, such as an attempt to expand its influence under the guise of protecting the overseas community. As for the Chinese living in Australia, those who actively choose to embrace the mainstream political values of the Australian society – opposing authoritarianism and advocating the universal values of democracy and human rights – are more likely to integrate into the mainstream society.

Some people have a myth that the respect of Chinese people abroad has something to do with China’s strength. In fact, no matter how weak a country a person comes from, what matters is whether he or she is able to “put down roots”. It doesn’t matter where you come from, as long as you abide by the local laws and respect the local customs, you will be respected and accepted by the local people. Following the local customs is always the simplest and most appropriate way for every Chinese to settle down.

Article/Editorial Sameway

Photo/Internet

What to explore ?

Australia’s Multicultural Future

Hong Kong Speeds Up Article 23 Legislation in Full Swing, International Prospects Worrying

Taylor’s Cyclone

Two Years of Ukraine Crisis

Aftermath of Messi’s absence from Hong Kong Friendlies

Fraudulent ivermectin studies open up new battleground

Cantonese Mango Sago

NEMBC Arabic COVID 19 News – 14 June 2022

保护您自己和家人 – 咳嗽和打喷嚏时请捂住

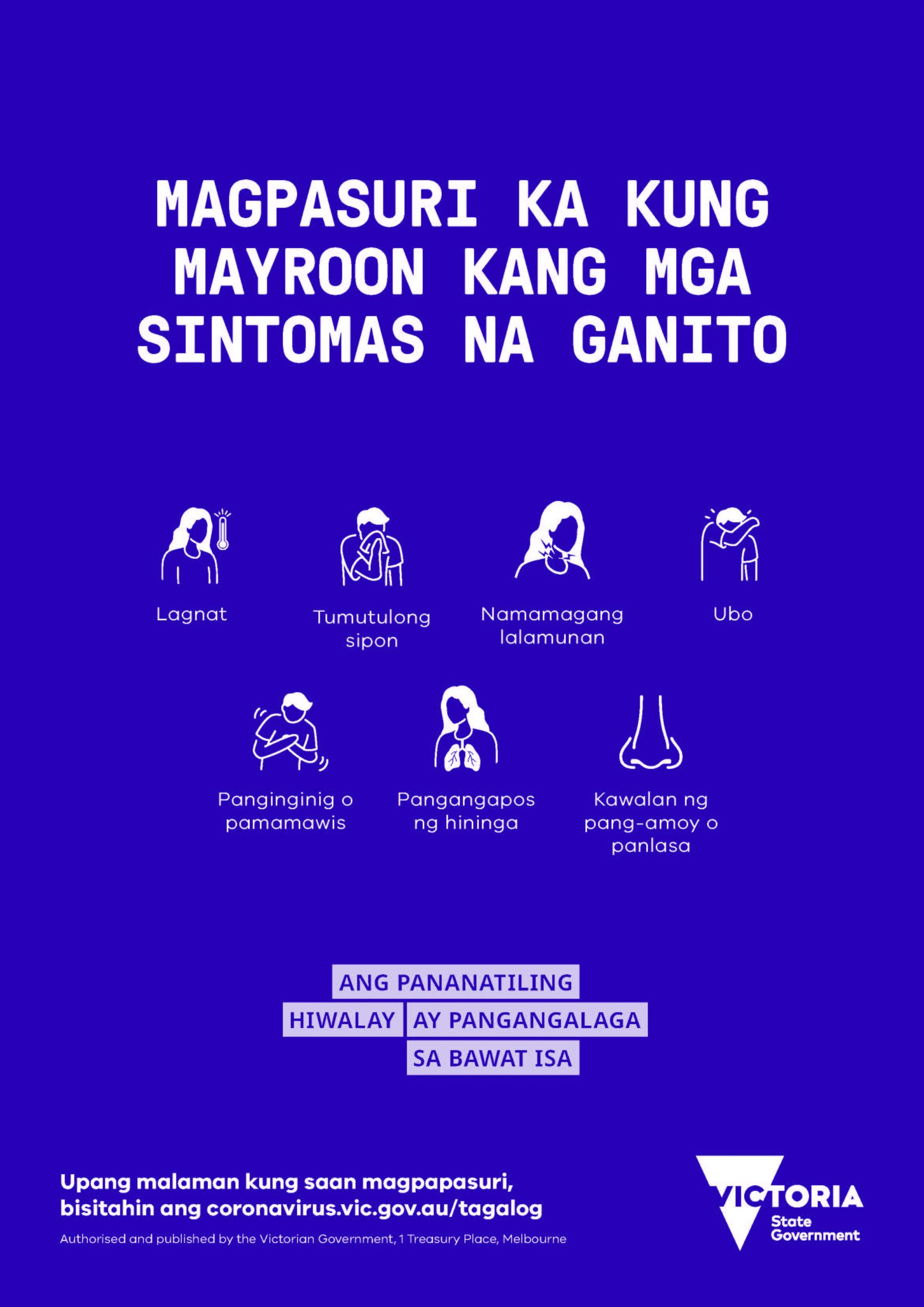

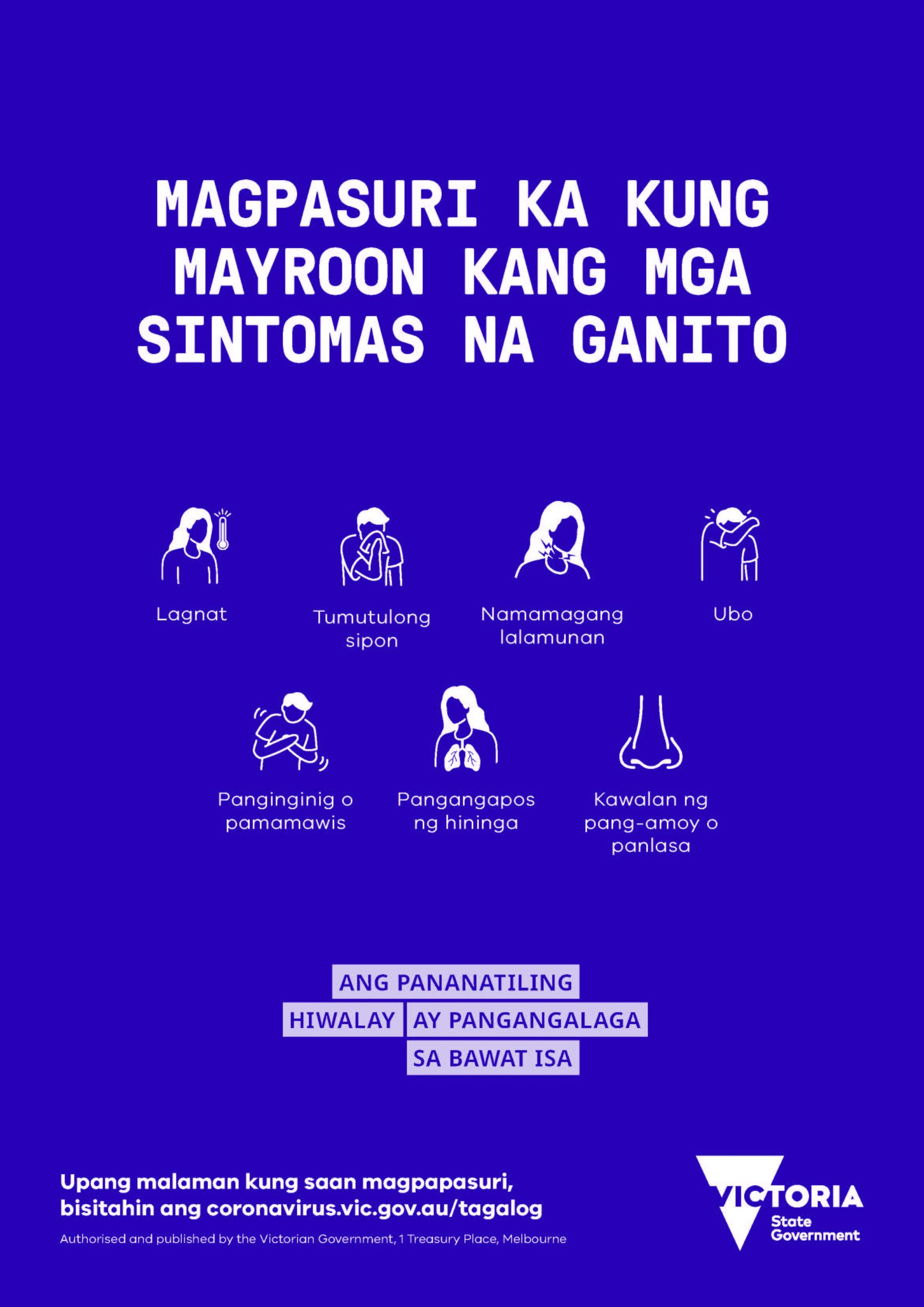

FILIPINO: Kung nakakaranas ka ng mga sumusunod na sintomas, mangyaring subukan.

Trending

-

COVID-19 Around the World3 years ago

COVID-19 Around the World3 years agoFraudulent ivermectin studies open up new battleground

-

Cuisine Explorer4 years ago

Cuisine Explorer4 years agoCantonese Mango Sago

-

Arabic2 years ago

Arabic2 years agoNEMBC Arabic COVID 19 News – 14 June 2022

-

Cantonese - Traditional Chinese4 years ago

Cantonese - Traditional Chinese4 years ago保护您自己和家人 – 咳嗽和打喷嚏时请捂住

-

Tagalog4 years ago

Tagalog4 years agoFILIPINO: Kung nakakaranas ka ng mga sumusunod na sintomas, mangyaring subukan.

-

Uncategorized4 years ago

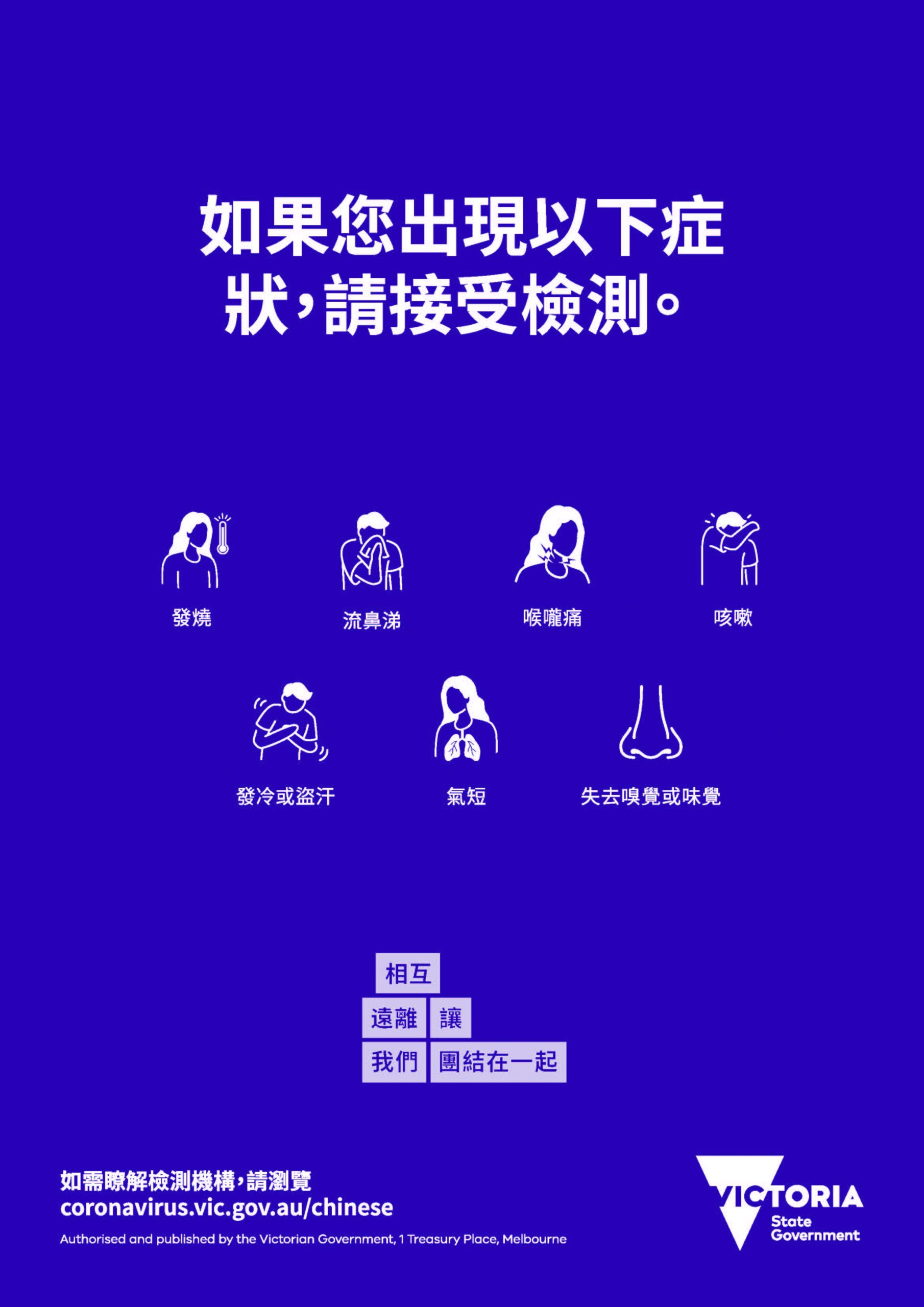

Uncategorized4 years ago如果您出現以下症狀,請接受檢測。

-

Uncategorized4 years ago

在最近的 COVID-19 應對行動中, 維多利亞州並非孤單

-

Uncategorized4 years ago

Uncategorized4 years agoCOVID-19 檢驗快速 安全又簡單